Afrikaans

Afrikaans  Albanian

Albanian  Amharic

Amharic  Arabic

Arabic  Armenian

Armenian  Azerbaijani

Azerbaijani  Basque

Basque  Belarusian

Belarusian  Bengali

Bengali  Bosnian

Bosnian  Bulgarian

Bulgarian  Catalan

Catalan  Cebuano

Cebuano  Corsican

Corsican  Croatian

Croatian  Czech

Czech  Danish

Danish  Dutch

Dutch  English

English  Esperanto

Esperanto  Estonian

Estonian  Finnish

Finnish  French

French  Frisian

Frisian  Galician

Galician  Georgian

Georgian  German

German  Greek

Greek  Gujarati

Gujarati  Haitian Creole

Haitian Creole  hausa

hausa  hawaiian

hawaiian  Hebrew

Hebrew  Hindi

Hindi  Miao

Miao  Hungarian

Hungarian  Icelandic

Icelandic  igbo

igbo  Indonesian

Indonesian  irish

irish  Italian

Italian  Japanese

Japanese  Javanese

Javanese  Kannada

Kannada  kazakh

kazakh  Khmer

Khmer  Rwandese

Rwandese  Korean

Korean  Kurdish

Kurdish  Kyrgyz

Kyrgyz  Lao

Lao  Latin

Latin  Latvian

Latvian  Lithuanian

Lithuanian  Luxembourgish

Luxembourgish  Macedonian

Macedonian  Malgashi

Malgashi  Malay

Malay  Malayalam

Malayalam  Maltese

Maltese  Maori

Maori  Marathi

Marathi  Mongolian

Mongolian  Myanmar

Myanmar  Nepali

Nepali  Norwegian

Norwegian  Norwegian

Norwegian  Occitan

Occitan  Pashto

Pashto  Persian

Persian  Polish

Polish  Portuguese

Portuguese  Punjabi

Punjabi  Romanian

Romanian  Russian

Russian  Samoan

Samoan  Scottish Gaelic

Scottish Gaelic  Serbian

Serbian  Sesotho

Sesotho  Shona

Shona  Sindhi

Sindhi  Sinhala

Sinhala  Slovak

Slovak  Slovenian

Slovenian  Somali

Somali  Spanish

Spanish  Sundanese

Sundanese  Swahili

Swahili  Swedish

Swedish  Tagalog

Tagalog  Tajik

Tajik  Tamil

Tamil  Tatar

Tatar  Telugu

Telugu  Thai

Thai  Turkish

Turkish  Turkmen

Turkmen  Ukrainian

Ukrainian  Urdu

Urdu  Uighur

Uighur  Uzbek

Uzbek  Vietnamese

Vietnamese  Welsh

Welsh  Bantu

Bantu  Yiddish

Yiddish  Yoruba

Yoruba  Zulu

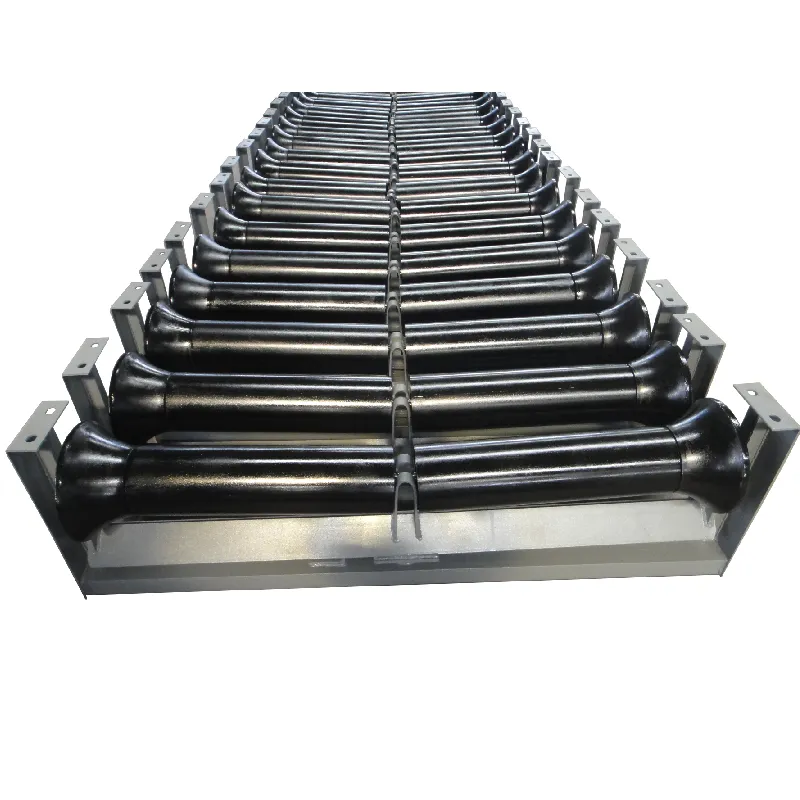

Zulu v return idler

Understanding the Concept of Return Idler in Financial Contexts

In the intricate realm of finance, various terms and concepts often surface, each imbued with significant implications for investors, analysts, and policymakers alike. One such term that warrants our attention is the return idler. While this term may not be as commonly discussed as others, understanding its implications can provide valuable insights into investment strategies, market behaviors, and risk management.

What is Return Idler?

The concept of return idler typically refers to a situation in investment portfolios where assets are not generating expected returns or are underperforming relative to their potential. This condition can arise from various factors, including market volatility, poor asset selection, or unfavorable economic conditions. In essence, a return idler denotes an investment that, while ostensibly productive, fails to yield the anticipated financial benefits.

For investors, the return idler can pose significant challenges. When capital is allocated to investments that do not perform admirably, it diminishes the overall portfolio's potential for growth and financial strength. Consequently, investors must be adept at identifying such assets and making informed decisions about whether to hold, modify, or divest these investments.

Identifying Return Idler Assets

Investors can utilize several strategies to identify return idler assets within their portfolios. One effective method is through regular portfolio performance reviews. By comparing the performance of each asset against relevant benchmarks or indices, investors can pinpoint those that are lagging or underperforming. Further, employing analytical tools such as the Sharpe ratio or other risk-adjusted return measures can help in assessing an asset's performance relative to its risk profile.

Additionally, staying abreast of market trends and economic conditions is crucial. Economic downturns, changes in interest rates, or shifts in consumer behavior can significantly impact asset performance. Being aware of these external factors can provide deeper insights into why certain assets may be idling in terms of returns.

v return idler

Strategies to Address Return Idler

Once identified, addressing return idler assets within an investment portfolio is crucial to maintaining overall financial health. Here are a few strategies that investors might employ

1. Reallocating Assets One of the most straightforward approaches is reallocating capital from underperforming investments into higher-performing opportunities. By redirecting resources, investors can optimize their portfolio to better reflect their financial goals.

2. Enhancing Research and Analysis Investing in thorough market research and analysis can uncover reasons behind an asset's underperformance. This knowledge can guide investment decisions, potentially leading to a successful turnaround for struggling investments.

3. Engagement and Monitoring For investors in equities, actively engaging with company management can provide insights into operational strategies and future outlooks. Regular monitoring of invested assets ensures that any shifts in performance can be promptly addressed.

4. Diversifying Investments Diversification remains a proven strategy against the idlery of certain assets. By spreading investments across different sectors and asset classes, investors can mitigate risks and enhance potential returns.

Conclusion

In conclusion, understanding the concept of return idler and its implications is essential for investors striving for a robust portfolio. Regular evaluation, strategic resource allocation, and informed decision-making can help identify and address underperforming assets. As the financial landscape continues to evolve, staying vigilant and adaptable will ensure that investors not only safeguard their capital but also optimize it for future growth. The essence of successful investing lies in the continuous pursuit of better returns, and alleviating the burden of return idlers is a vital step in that journey.

-

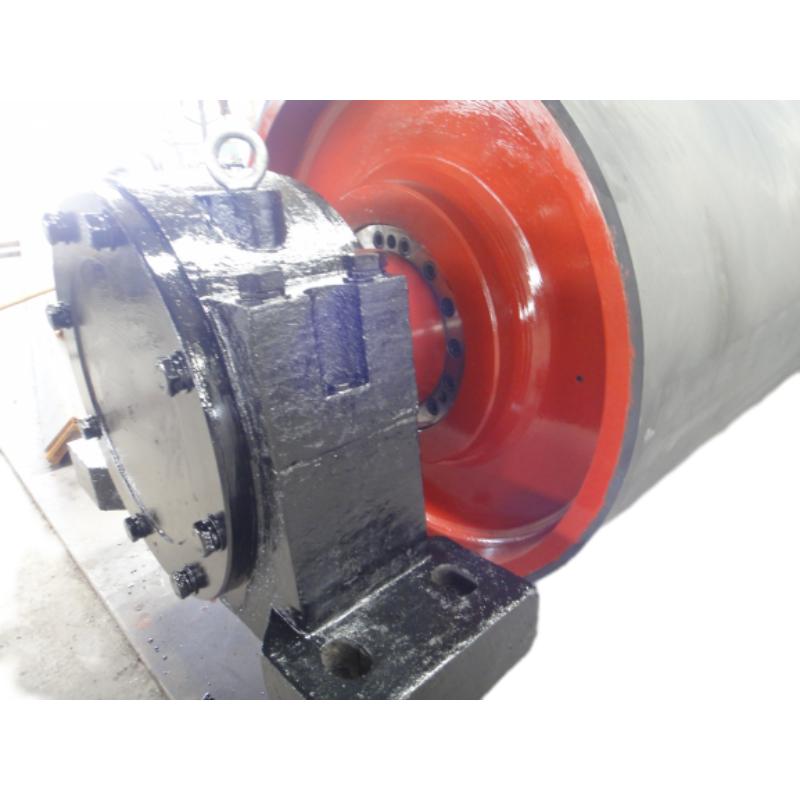

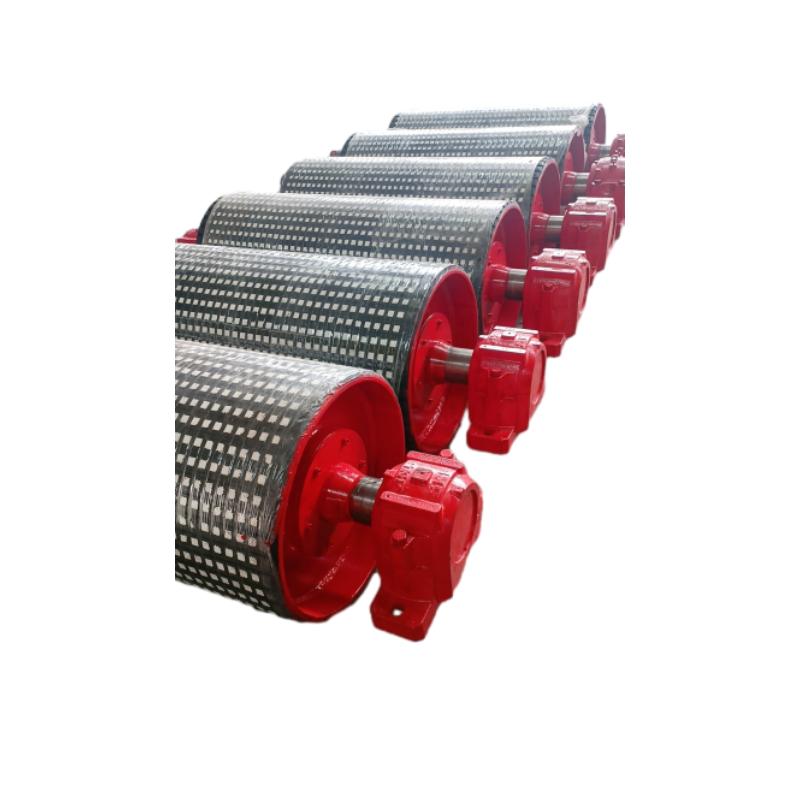

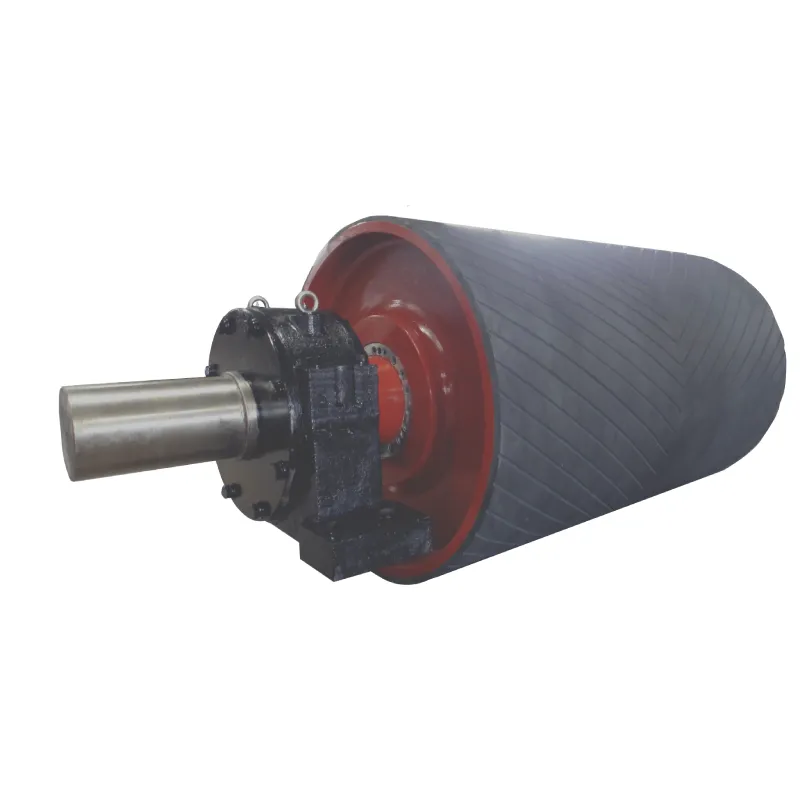

Revolutionizing Conveyor Reliability with Advanced Rubber Lagging PulleysNewsJul.22,2025

-

Powering Precision and Durability with Expert Manufacturers of Conveyor ComponentsNewsJul.22,2025

-

Optimizing Conveyor Systems with Advanced Conveyor AccessoriesNewsJul.22,2025

-

Maximize Conveyor Efficiency with Quality Conveyor Idler PulleysNewsJul.22,2025

-

Future-Proof Your Conveyor System with High-Performance Polyurethane RollerNewsJul.22,2025

-

Driving Efficiency Forward with Quality Idlers and RollersNewsJul.22,2025