Afrikaans

Afrikaans  Albanian

Albanian  Amharic

Amharic  Arabic

Arabic  Armenian

Armenian  Azerbaijani

Azerbaijani  Basque

Basque  Belarusian

Belarusian  Bengali

Bengali  Bosnian

Bosnian  Bulgarian

Bulgarian  Catalan

Catalan  Cebuano

Cebuano  Corsican

Corsican  Croatian

Croatian  Czech

Czech  Danish

Danish  Dutch

Dutch  English

English  Esperanto

Esperanto  Estonian

Estonian  Finnish

Finnish  French

French  Frisian

Frisian  Galician

Galician  Georgian

Georgian  German

German  Greek

Greek  Gujarati

Gujarati  Haitian Creole

Haitian Creole  hausa

hausa  hawaiian

hawaiian  Hebrew

Hebrew  Hindi

Hindi  Miao

Miao  Hungarian

Hungarian  Icelandic

Icelandic  igbo

igbo  Indonesian

Indonesian  irish

irish  Italian

Italian  Japanese

Japanese  Javanese

Javanese  Kannada

Kannada  kazakh

kazakh  Khmer

Khmer  Rwandese

Rwandese  Korean

Korean  Kurdish

Kurdish  Kyrgyz

Kyrgyz  Lao

Lao  Latin

Latin  Latvian

Latvian  Lithuanian

Lithuanian  Luxembourgish

Luxembourgish  Macedonian

Macedonian  Malgashi

Malgashi  Malay

Malay  Malayalam

Malayalam  Maltese

Maltese  Maori

Maori  Marathi

Marathi  Mongolian

Mongolian  Myanmar

Myanmar  Nepali

Nepali  Norwegian

Norwegian  Norwegian

Norwegian  Occitan

Occitan  Pashto

Pashto  Persian

Persian  Polish

Polish  Portuguese

Portuguese  Punjabi

Punjabi  Romanian

Romanian  Russian

Russian  Samoan

Samoan  Scottish Gaelic

Scottish Gaelic  Serbian

Serbian  Sesotho

Sesotho  Shona

Shona  Sindhi

Sindhi  Sinhala

Sinhala  Slovak

Slovak  Slovenian

Slovenian  Somali

Somali  Spanish

Spanish  Sundanese

Sundanese  Swahili

Swahili  Swedish

Swedish  Tagalog

Tagalog  Tajik

Tajik  Tamil

Tamil  Tatar

Tatar  Telugu

Telugu  Thai

Thai  Turkish

Turkish  Turkmen

Turkmen  Ukrainian

Ukrainian  Urdu

Urdu  Uighur

Uighur  Uzbek

Uzbek  Vietnamese

Vietnamese  Welsh

Welsh  Bantu

Bantu  Yiddish

Yiddish  Yoruba

Yoruba  Zulu

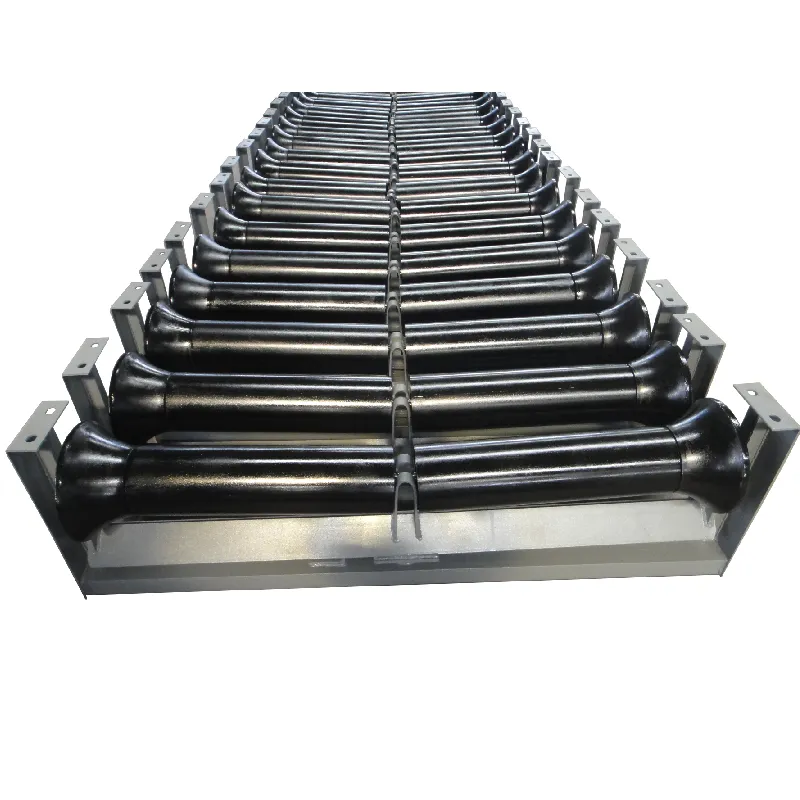

Zulu v return idler

Understanding the V% Return Idler in Financial Analysis

In financial analysis, the concept of return is paramount. Investors and analysts are continuously searching for metrics that can help predict future performance of investments and strategies. One such metric is the V% return idler, a term gaining traction among finance professionals. This article delves into the definition, significance, and application of V% return idler in the realm of investment and portfolio management.

What is V% Return Idler?

At its core, the V% return idler is a metric used to evaluate the return on an investment relative to a benchmark or risk-free asset, often expressed as a percentage. The V% typically signifies the volatility component in the return calculation, which accounts for the swings in the investment's value over time. The term “idler” refers to a state of inaction or stagnation, implying that the return is calculated during periods when the asset experiences minimal growth or decline.

Calculating the V% return involves analyzing both the gross returns realized by an asset or portfolio and adjusting these figures to account for the volatility evident during a given timeframe. By incorporating the concept of idleness, this return metric provides a clearer picture of how assets perform under duress or slow growth conditions, which could be crucial for risk assessment.

Why is V% Return Idler Important?

The significance of the V% return idler lies in its capacity to reveal weaknesses in investment strategies. While many investors chase high returns, understanding volatility and periods of stagnation can lead to more informed decision-making. For instance, investors who focus solely on high returns may overlook the risks involved with volatile assets that could lead to substantial losses during downturns.

v return idler

By assessing the V% return idler, analysts can better gauge the performance of assets during less favorable market conditions. This can lead to adjustments in investment strategies, allowing for more resilient portfolios. Moreover, it helps investors understand whether their returns are sustainable over time or just the result of transient market conditions.

Applications of V% Return Idler

The V% return idler can be applied in various areas of financial analysis and portfolio management. For asset managers, it acts as a diagnostic tool to evaluate current holdings, particularly in an environment characterized by market volatility. If a portfolio exhibits a high V% return idler, it might be time to reassess the investment strategy or consider diversification to spread risk.

For individual investors, understanding this metric can lead to more strategic investment choices rather than impulsive buying or selling based on short-term market fluctuations. By considering how investments perform during idle market periods, investors can build stronger portfolios that are capable of weathering economic cycles.

Conclusion

In conclusion, the V% return idler represents a valuable metric for both analysts and individual investors. It emphasizes the importance of understanding not just the returns on investments, but the context in which these returns occur. By focusing on volatility and periods of stagnation, investors can make more informed decisions and develop strategies that are not only focused on gains but also on risk management. As market conditions continue to change rapidly, the ability to analyze and interpret the V% return idler will undoubtedly play a critical role in ensuring investment success and sustainability.

-

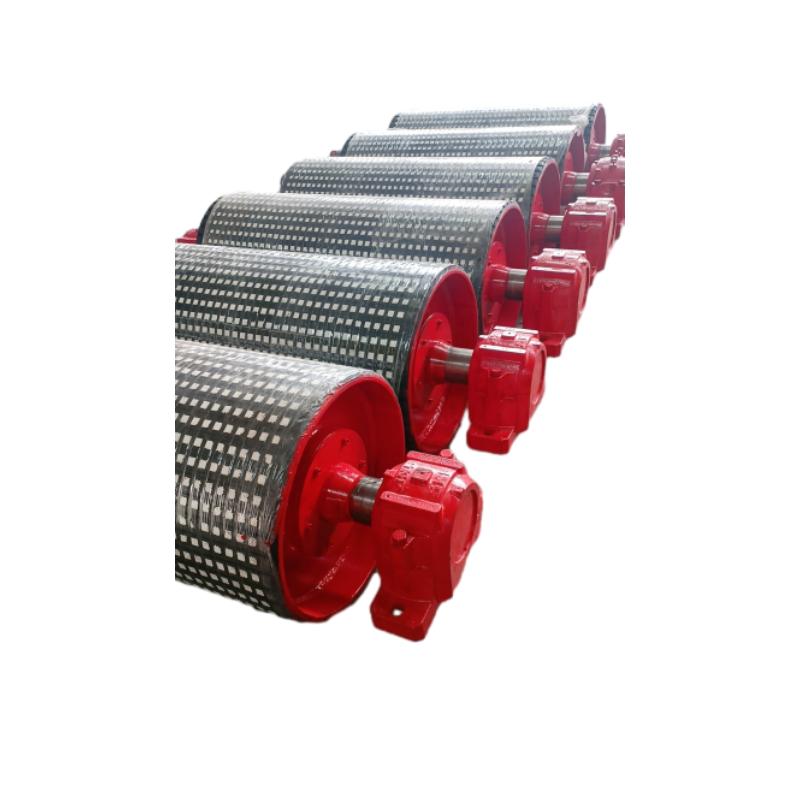

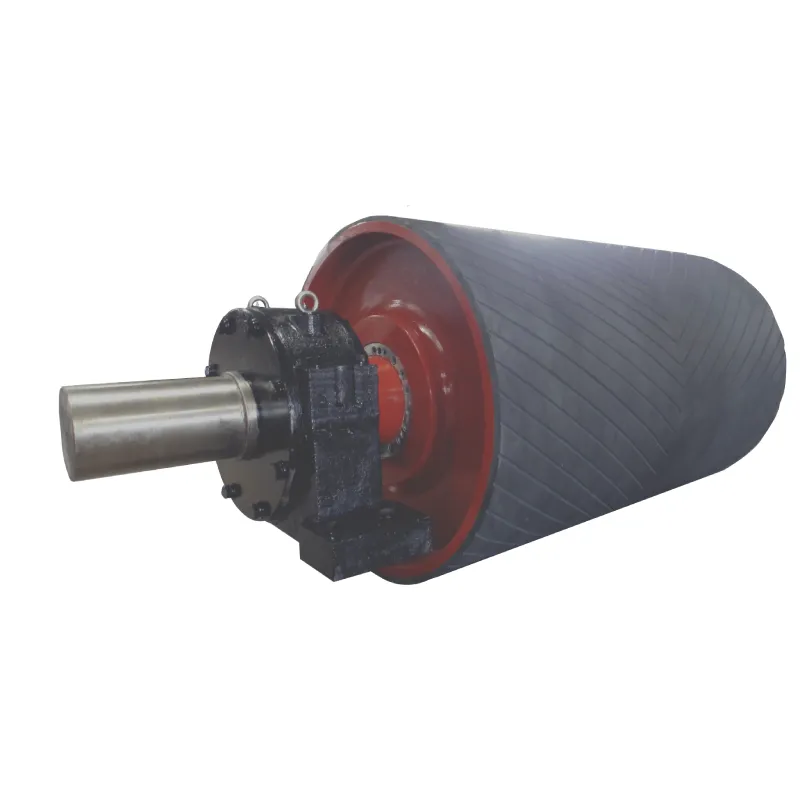

Revolutionizing Conveyor Reliability with Advanced Rubber Lagging PulleysNewsJul.22,2025

-

Powering Precision and Durability with Expert Manufacturers of Conveyor ComponentsNewsJul.22,2025

-

Optimizing Conveyor Systems with Advanced Conveyor AccessoriesNewsJul.22,2025

-

Maximize Conveyor Efficiency with Quality Conveyor Idler PulleysNewsJul.22,2025

-

Future-Proof Your Conveyor System with High-Performance Polyurethane RollerNewsJul.22,2025

-

Driving Efficiency Forward with Quality Idlers and RollersNewsJul.22,2025