Afrikaans

Afrikaans  Albanian

Albanian  Amharic

Amharic  Arabic

Arabic  Armenian

Armenian  Azerbaijani

Azerbaijani  Basque

Basque  Belarusian

Belarusian  Bengali

Bengali  Bosnian

Bosnian  Bulgarian

Bulgarian  Catalan

Catalan  Cebuano

Cebuano  Corsican

Corsican  Croatian

Croatian  Czech

Czech  Danish

Danish  Dutch

Dutch  English

English  Esperanto

Esperanto  Estonian

Estonian  Finnish

Finnish  French

French  Frisian

Frisian  Galician

Galician  Georgian

Georgian  German

German  Greek

Greek  Gujarati

Gujarati  Haitian Creole

Haitian Creole  hausa

hausa  hawaiian

hawaiian  Hebrew

Hebrew  Hindi

Hindi  Miao

Miao  Hungarian

Hungarian  Icelandic

Icelandic  igbo

igbo  Indonesian

Indonesian  irish

irish  Italian

Italian  Japanese

Japanese  Javanese

Javanese  Kannada

Kannada  kazakh

kazakh  Khmer

Khmer  Rwandese

Rwandese  Korean

Korean  Kurdish

Kurdish  Kyrgyz

Kyrgyz  Lao

Lao  Latin

Latin  Latvian

Latvian  Lithuanian

Lithuanian  Luxembourgish

Luxembourgish  Macedonian

Macedonian  Malgashi

Malgashi  Malay

Malay  Malayalam

Malayalam  Maltese

Maltese  Maori

Maori  Marathi

Marathi  Mongolian

Mongolian  Myanmar

Myanmar  Nepali

Nepali  Norwegian

Norwegian  Norwegian

Norwegian  Occitan

Occitan  Pashto

Pashto  Persian

Persian  Polish

Polish  Portuguese

Portuguese  Punjabi

Punjabi  Romanian

Romanian  Russian

Russian  Samoan

Samoan  Scottish Gaelic

Scottish Gaelic  Serbian

Serbian  Sesotho

Sesotho  Shona

Shona  Sindhi

Sindhi  Sinhala

Sinhala  Slovak

Slovak  Slovenian

Slovenian  Somali

Somali  Spanish

Spanish  Sundanese

Sundanese  Swahili

Swahili  Swedish

Swedish  Tagalog

Tagalog  Tajik

Tajik  Tamil

Tamil  Tatar

Tatar  Telugu

Telugu  Thai

Thai  Turkish

Turkish  Turkmen

Turkmen  Ukrainian

Ukrainian  Urdu

Urdu  Uighur

Uighur  Uzbek

Uzbek  Vietnamese

Vietnamese  Welsh

Welsh  Bantu

Bantu  Yiddish

Yiddish  Yoruba

Yoruba  Zulu

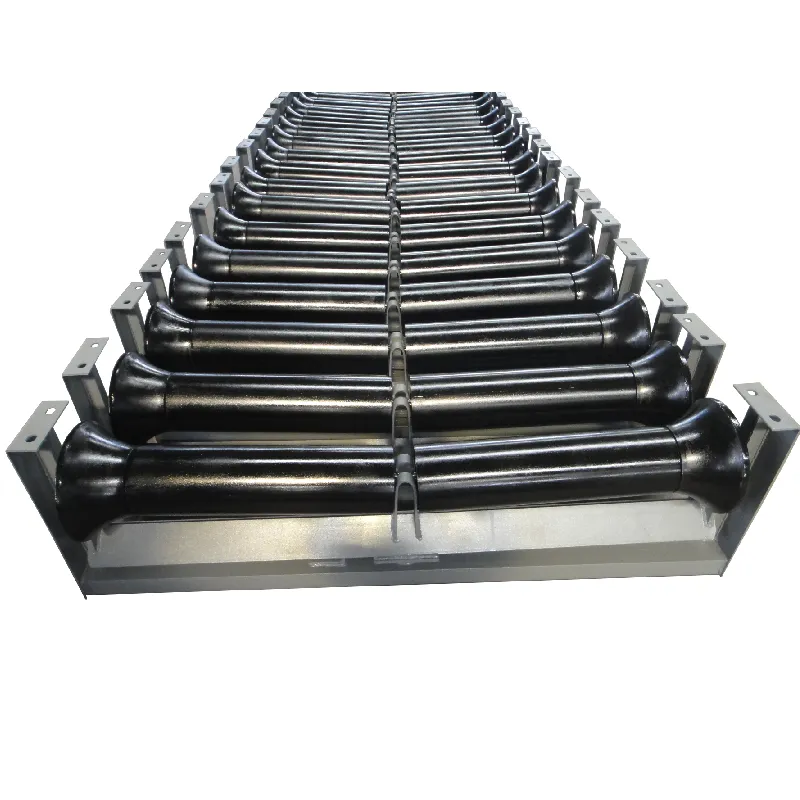

Zulu return idler

The Concept of Return Idler A Path to Enhanced Returns

In the realm of investment and finance, a term that often emerges is return idler. While it may sound casual, it encapsulates a critical principle that every investor should understand the importance of actively managing investments to maximize returns over time.

At its core, the concept of return idler refers to any period where capital is not being utilized efficiently to generate profit. This situation can arise from various circumstances—whether it's holding onto underperforming assets, failing to reinvest gains, or simply allowing significant cash reserves to sit idle without a strategic deployment. In essence, it highlights the opportunity cost of not utilizing resources in a way that could yield greater returns.

One of the primary reasons investors fall into the trap of return idler is the fear of market volatility

. Many tend to gravitate towards perceived safety, such as keeping cash on hand or sticking with low-yield investments. While a certain degree of caution is essential, allowing assets to languish without active management can significantly erode potential gains. Historical data shows that markets tend to reward those who embrace a long-term perspective and invest consistently, regardless of short-term fluctuations.return idler

To combat the return idler mentality, investors can adopt several strategies. Diversification is crucial; spreading investments across various asset classes can reduce risk and improve the likelihood of favorable returns. Additionally, regularly reviewing and rebalancing a portfolio ensures that investments align with current market conditions and individual financial goals. This involves not only identifying underperforming assets but also recognizing opportunities in emerging markets or industries.

Another effective method to mitigate the effects of a return idler is to consider automated investing platforms or robo-advisors. These tools utilize algorithms to create optimal portfolios based on individual risk tolerance and investment goals, ensuring that funds are actively managed even when investors may not have the time or expertise to do so themselves.

Moreover, education plays a vital role in overcoming the barriers of return idler. Investors should continuously seek knowledge about market trends, investment strategies, and financial planning. By understanding market dynamics, individuals can make informed decisions and feel more confident about deploying their capital effectively.

In conclusion, the return idler concept serves as a reminder that money, when not actively managed, loses its potential to grow. By recognizing the dangers of inaction and employing strategic investment practices, investors can transform idle assets into lucrative opportunities, ultimately enhancing their financial well-being and securing a more prosperous future. Embracing active investment management is not just a choice; it’s a necessity in the pursuit of financial success.

-

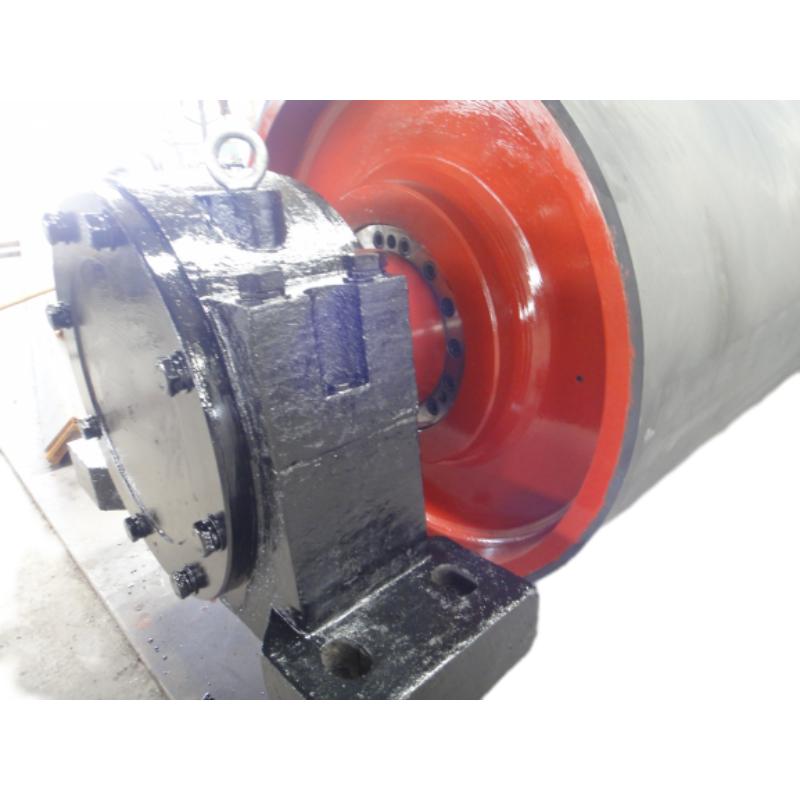

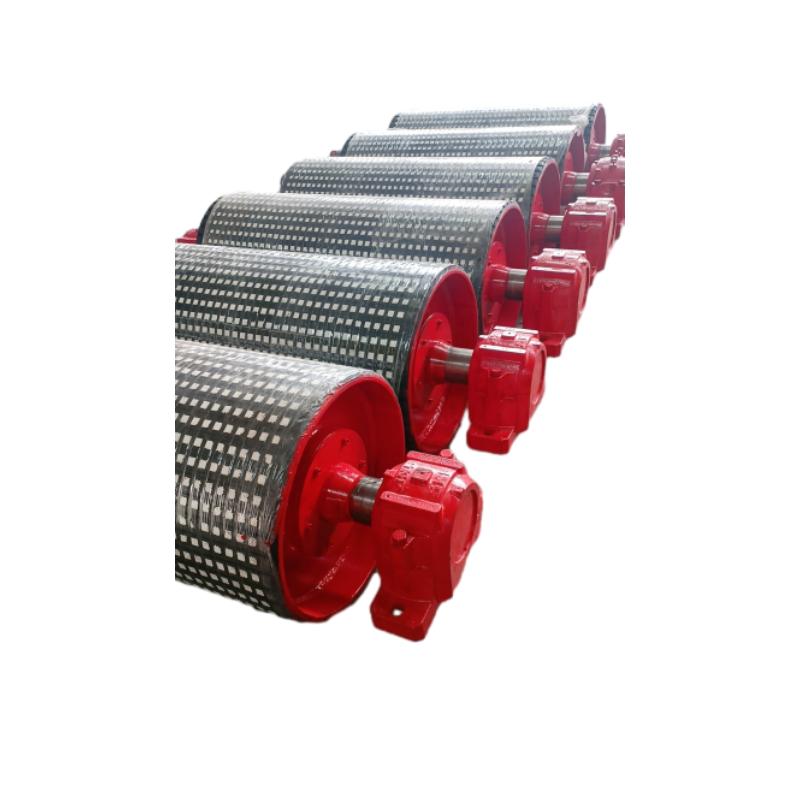

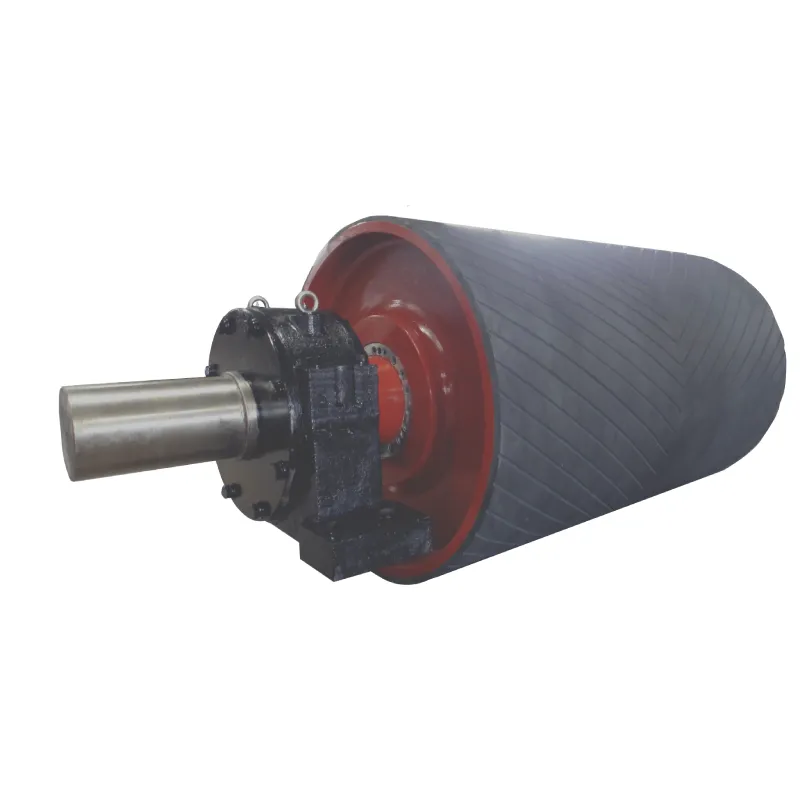

Revolutionizing Conveyor Reliability with Advanced Rubber Lagging PulleysNewsJul.22,2025

-

Powering Precision and Durability with Expert Manufacturers of Conveyor ComponentsNewsJul.22,2025

-

Optimizing Conveyor Systems with Advanced Conveyor AccessoriesNewsJul.22,2025

-

Maximize Conveyor Efficiency with Quality Conveyor Idler PulleysNewsJul.22,2025

-

Future-Proof Your Conveyor System with High-Performance Polyurethane RollerNewsJul.22,2025

-

Driving Efficiency Forward with Quality Idlers and RollersNewsJul.22,2025