Afrikaans

Afrikaans  Albanian

Albanian  Amharic

Amharic  Arabic

Arabic  Armenian

Armenian  Azerbaijani

Azerbaijani  Basque

Basque  Belarusian

Belarusian  Bengali

Bengali  Bosnian

Bosnian  Bulgarian

Bulgarian  Catalan

Catalan  Cebuano

Cebuano  Corsican

Corsican  Croatian

Croatian  Czech

Czech  Danish

Danish  Dutch

Dutch  English

English  Esperanto

Esperanto  Estonian

Estonian  Finnish

Finnish  French

French  Frisian

Frisian  Galician

Galician  Georgian

Georgian  German

German  Greek

Greek  Gujarati

Gujarati  Haitian Creole

Haitian Creole  hausa

hausa  hawaiian

hawaiian  Hebrew

Hebrew  Hindi

Hindi  Miao

Miao  Hungarian

Hungarian  Icelandic

Icelandic  igbo

igbo  Indonesian

Indonesian  irish

irish  Italian

Italian  Japanese

Japanese  Javanese

Javanese  Kannada

Kannada  kazakh

kazakh  Khmer

Khmer  Rwandese

Rwandese  Korean

Korean  Kurdish

Kurdish  Kyrgyz

Kyrgyz  Lao

Lao  Latin

Latin  Latvian

Latvian  Lithuanian

Lithuanian  Luxembourgish

Luxembourgish  Macedonian

Macedonian  Malgashi

Malgashi  Malay

Malay  Malayalam

Malayalam  Maltese

Maltese  Maori

Maori  Marathi

Marathi  Mongolian

Mongolian  Myanmar

Myanmar  Nepali

Nepali  Norwegian

Norwegian  Norwegian

Norwegian  Occitan

Occitan  Pashto

Pashto  Persian

Persian  Polish

Polish  Portuguese

Portuguese  Punjabi

Punjabi  Romanian

Romanian  Russian

Russian  Samoan

Samoan  Scottish Gaelic

Scottish Gaelic  Serbian

Serbian  Sesotho

Sesotho  Shona

Shona  Sindhi

Sindhi  Sinhala

Sinhala  Slovak

Slovak  Slovenian

Slovenian  Somali

Somali  Spanish

Spanish  Sundanese

Sundanese  Swahili

Swahili  Swedish

Swedish  Tagalog

Tagalog  Tajik

Tajik  Tamil

Tamil  Tatar

Tatar  Telugu

Telugu  Thai

Thai  Turkish

Turkish  Turkmen

Turkmen  Ukrainian

Ukrainian  Urdu

Urdu  Uighur

Uighur  Uzbek

Uzbek  Vietnamese

Vietnamese  Welsh

Welsh  Bantu

Bantu  Yiddish

Yiddish  Yoruba

Yoruba  Zulu

Zulu Exploring the Benefits of a Return Manager in E-commerce Operations

The Concept of Return Idler Understanding Its Importance and Implications

In the world of finance and investing, the term return idler may seem unfamiliar at first glance. However, it encapsulates a vital concept that underscores part of the investment strategy spectrum. Essentially, a return idler refers to an investment or asset that generates little or no return for a prolonged period. This concept is crucial for both individual and institutional investors as they strive to optimize their portfolios while minimizing risks.

The Allure of Potential Returns

Investors are often tempted by the allure of high returns, chasing the latest trends or speculative assets. In this pursuit, they may overlook the fundamental principle that not every investment will yield immediate or exciting results. A return idler often represents a holding that, while not actively generating returns, serves a specific role within a diversified portfolio. These investments can include cash holdings, government bonds, or even real estate in certain market conditions.

Understanding return idlers is essential for several reasons. First, they help anchor a portfolio during volatile times. In periods of market uncertainty, high-risk assets may experience significant fluctuations, while more stable return idlers can provide a sense of security. Investors should be aware of how these idlers can cushion their portfolios against market shocks.

The Role of Time Horizon

An essential aspect of understanding return idlers is recognizing the time horizon of investments. What may appear to be a return idler in the short term could turn into a significant asset over a prolonged period. For example, investments in growth stocks might not show returns immediately due to market conditions or company performance but could deliver remarkable gains in the long run. Investors need to have patience and a well-thought-out strategy to determine when to hold on to or divest these idlers.

return idler

Moreover, the concept of opportunity cost is crucial when analyzing return idlers. Allocating capital to investments that generate minimal returns can lead to lost opportunities elsewhere. Investors often grapple with the balance between stability and growth, and it’s vital to reassess their portfolios regularly. Engaging in periodic portfolio reviews helps identify potential return idlers that may no longer align with investment goals.

The Impact on Financial Strategy

Incorporating return idlers within an investment strategy requires a balanced approach. While diversifying a portfolio with low-return assets can provide stability, it is equally important to ensure that the potential for higher returns is not entirely sacrificed. This is where investment strategy comes into play—crafting a mixture of assets that include both high-growth options and stable return idlers can help in achieving long-term financial objectives.

Furthermore, understanding the market dynamics that lead to certain assets becoming return idlers is crucial for investors. Economic factors, interest rates, and market sentiment all influence return generation. By being informed about these aspects, investors can better position themselves to transition from return idlers to high-return assets when conditions change favorably.

Conclusion

The return idler serves as a reminder that not all investments operate under the principle of immediate returns. They play a complex and essential role within a broader investment strategy, offering benefits in terms of stability, portfolio balance, and long-term growth potential. Investors should take a nuanced approach to these idlers, recognizing their significance while ensuring they remain aligned with their financial goals.

In conclusion, grasping the dynamics of return idlers empowers investors to hone their strategies and make informed decisions. As markets continue to evolve, understanding these seemingly dormant investments can provide a critical advantage, making it necessary to consider both their risks and rewards in the ever-changing landscape of finance. Balancing return idlers with more dynamic investments can result in a resilient portfolio capable of weathering the storm of market volatility while still capturing growth opportunities when they arise.

-

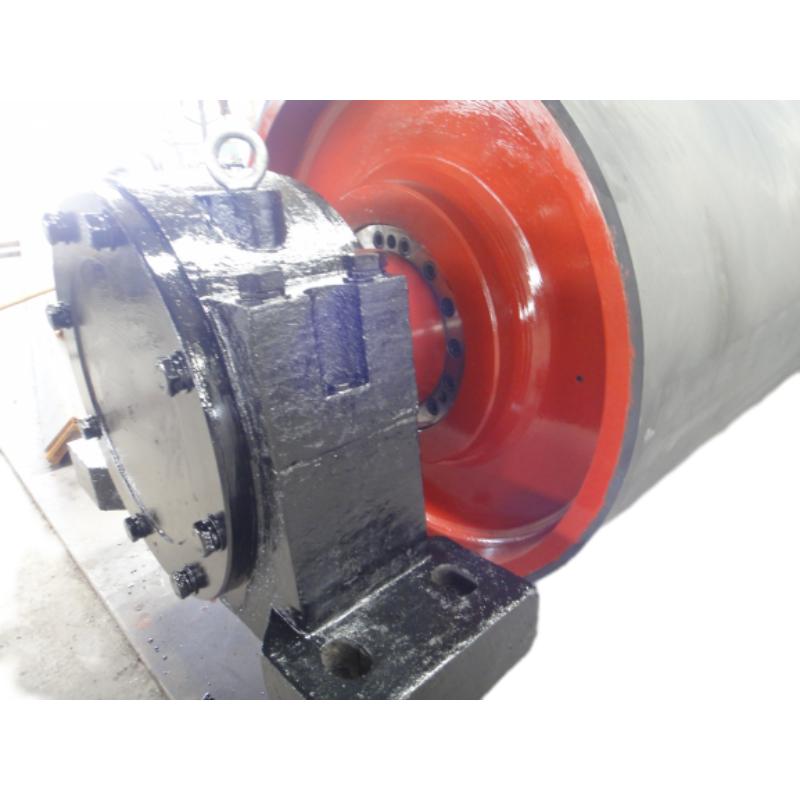

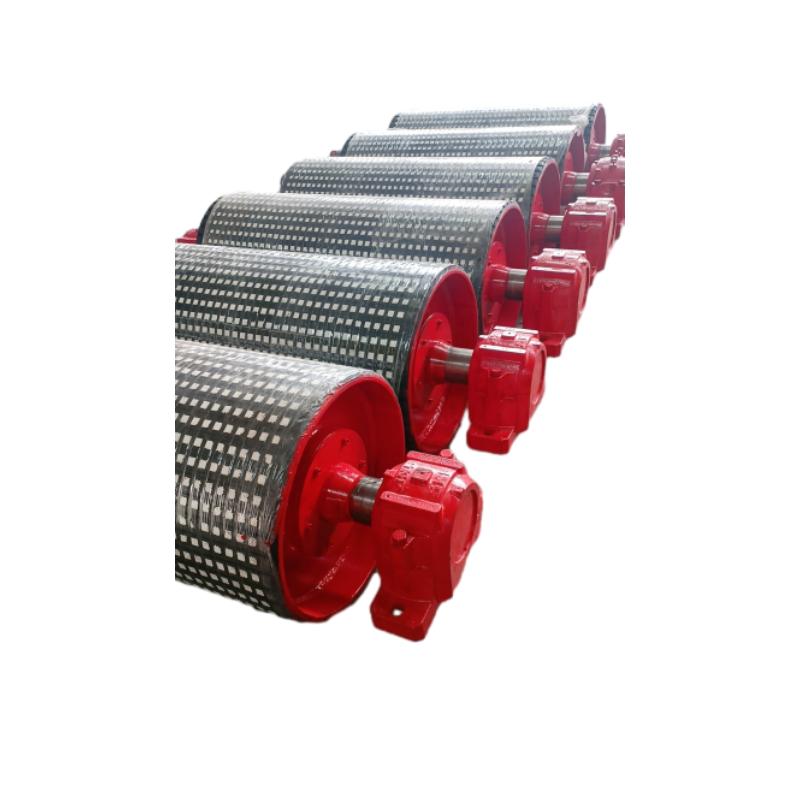

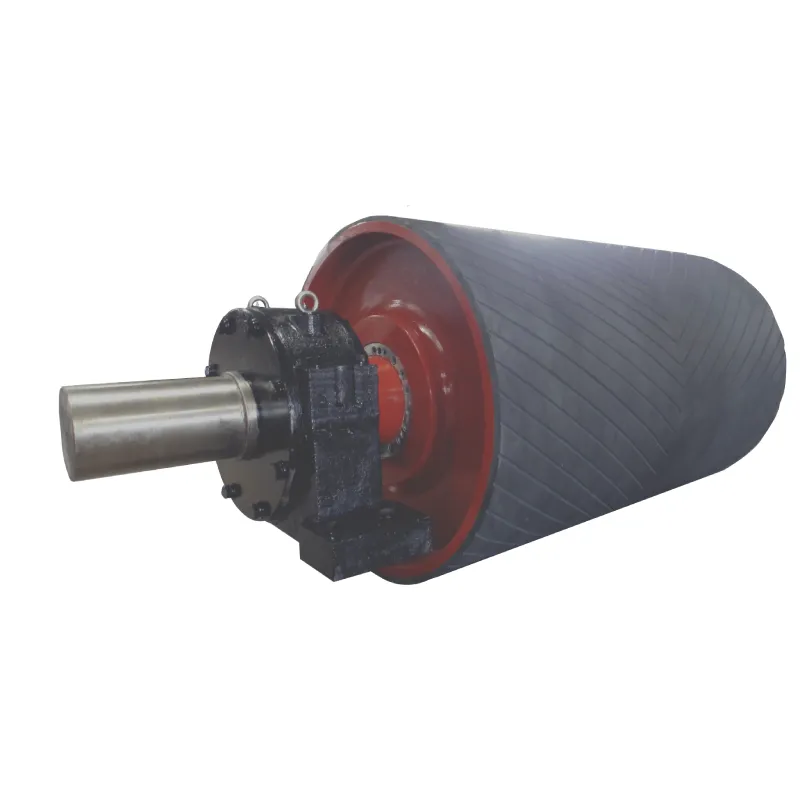

Revolutionizing Conveyor Reliability with Advanced Rubber Lagging PulleysNewsJul.22,2025

-

Powering Precision and Durability with Expert Manufacturers of Conveyor ComponentsNewsJul.22,2025

-

Optimizing Conveyor Systems with Advanced Conveyor AccessoriesNewsJul.22,2025

-

Maximize Conveyor Efficiency with Quality Conveyor Idler PulleysNewsJul.22,2025

-

Future-Proof Your Conveyor System with High-Performance Polyurethane RollerNewsJul.22,2025

-

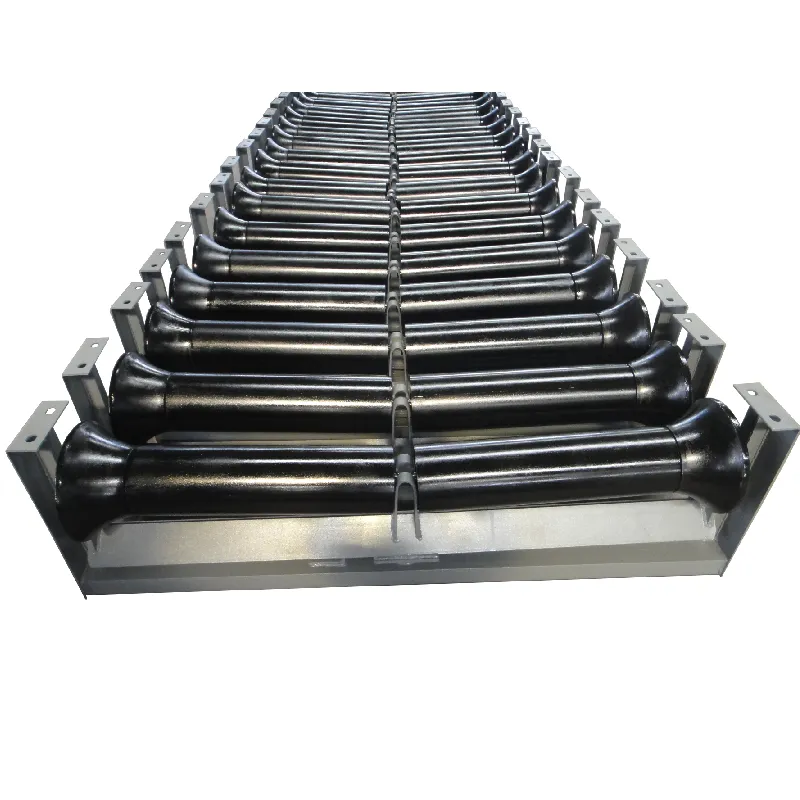

Driving Efficiency Forward with Quality Idlers and RollersNewsJul.22,2025